Irs auto depreciation calculator

Where Di is the depreciation in year i. If you are using the double declining.

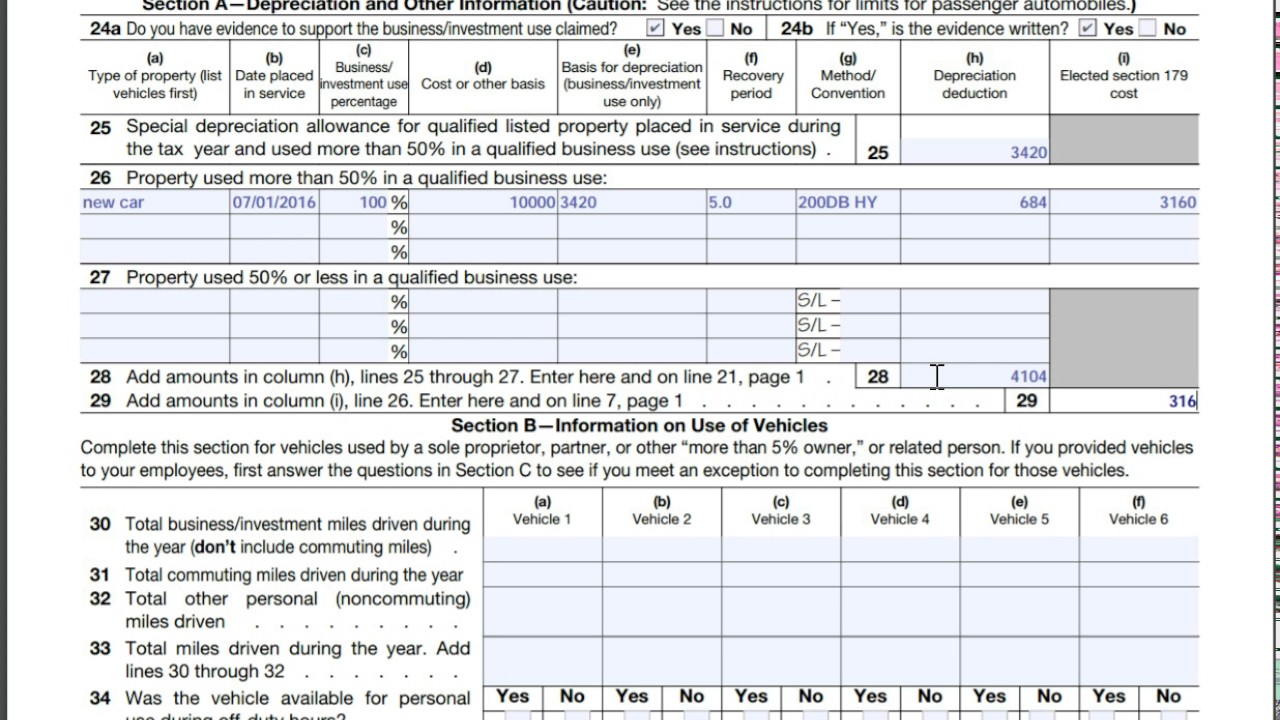

Form 4562 New Car Depreciation Youtube

Select the currency from the drop-down list optional Enter the.

. After two years your cars value decreases to 69. The following calculator is for depreciation calculation in accounting. How It Works.

Make the election under section 179 to expense certain property. If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to limits. The recovery period of property is the number of years over which you recover its cost or other basis.

Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items. 510 Business Use of Car. It is determined based on the depreciation system GDS or ADS used.

It takes the straight line declining balance or sum of the year digits method. This calculator will calculate the rate and expense amount for personal or real property for a given year. Our property depreciation calculator helps to calculate depreciation of residential rental or nonresidential.

C is the original purchase price or basis of an asset. The MACRS Depreciation Calculator uses the following basic formula. It provides a couple different methods of depreciation.

Claim your deduction for depreciation and amortization. Schedule C Form 1040 Profit or Loss From Business. It is fairly simple to use.

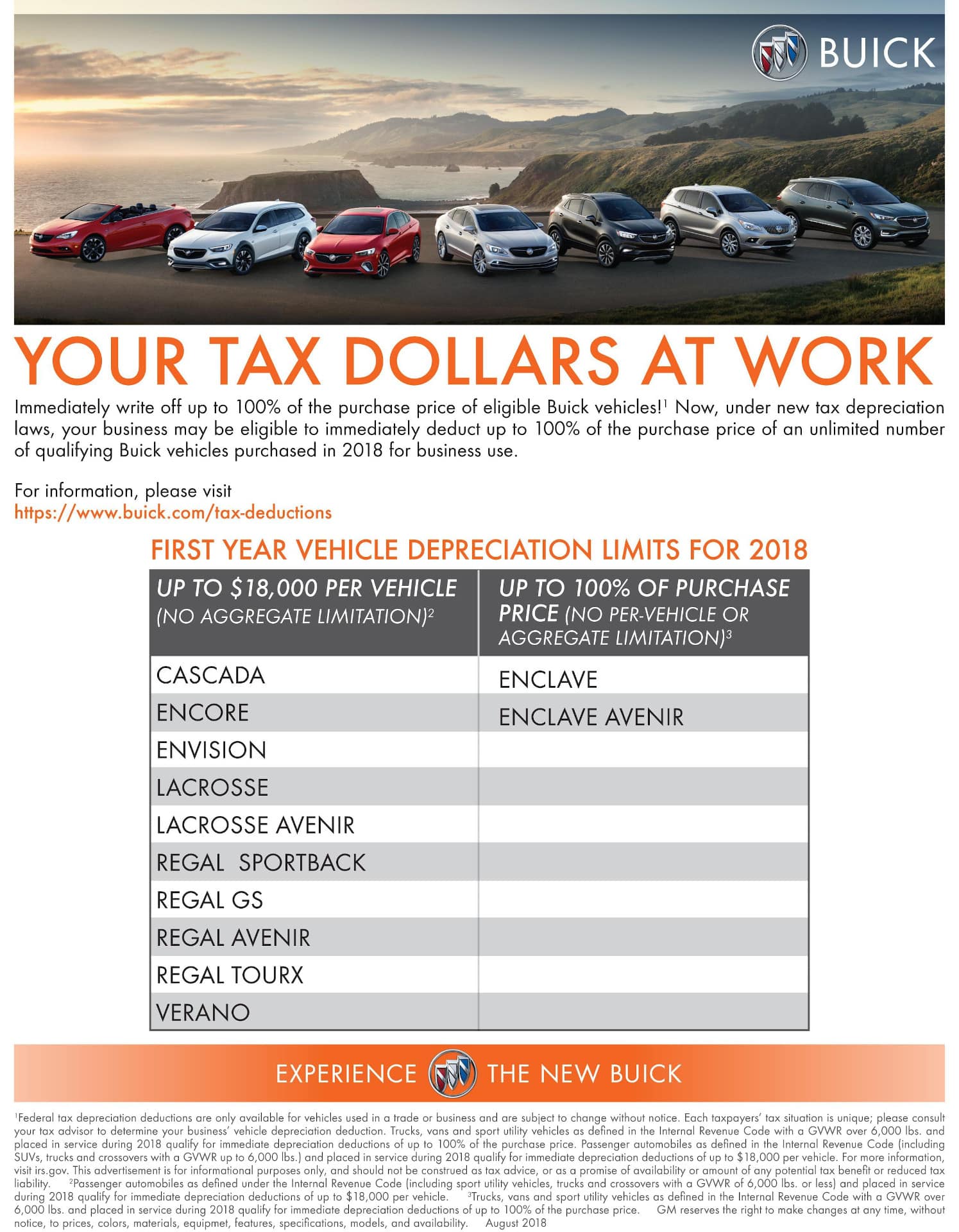

Table 2 provides depreciation deduction limits for passenger automobiles placed in service by the taxpayer during calendar year 2022 for which. The calculation is based on the Modified Accelerated Cost Recovery method as. After a few years the vehicle is not what it used to be in the beginning.

See how your refund take-home pay or tax due are affected by withholding amount. Use Form 4562 to. Provide information on the.

Calculate Property Depreciation With Property Depreciation Calculator. D i C R i. All you need to do is.

The calculator also estimates the first year and the total vehicle depreciation. Our car depreciation calculator uses the following values source. The general idea behind car depreciation for taxes is to spread the cost of a car out over its useful life instead of writing off its whole cost the year you buy it.

In the simplest terms depreciation is the decrease in valueImagine that you bought a car for 20000. This depreciation calculator is for calculating the depreciation schedule of an asset. Each Succeeding Year 6460.

Estimate your federal income tax withholding. If you use this method you need to figure depreciation for the vehicle. We will even custom tailor the results based upon just a few.

Use this tool to. Above is the best source of help for the tax code. After a year your cars value decreases to 81 of the initial value.

Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade. A P 1 - R100 n. You can claim business use of an automobile on.

The IRS has announced the 2022 inflation-adjusted Code 280F luxury automobile limits on certain deductions that may be taken by taxpayers using passenger automobiles. To calculate the impact of depreciation compare an example for a commercial truck worth 100000.

Automobile Depreciation Depreciation Guru

Automobile And Taxi Depreciation Calculation Depreciation Guru

Irs Announces Luxury Auto Depreciation Caps And Lease Inclusion Amounts Doeren Mayhew Cpas

Handling Us Tax Depreciation In Sap Part 6 Irs Passenger Vehicles Serio Consulting

100 Bonus Depreciation For Suvs For Your Business Youtube

Depreciation Of Computer Equipment Computer Equipment Best Computer Computer

Year End Tax Deduction Heyward Allen Motor Company Inc

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Macrs Depreciation Calculator Straight Line Double Declining

Car Depreciation Calculator Nationwide

Automobile And Taxi Depreciation Calculation Depreciation Guru

Car Depreciation Calculator Calculate Straightline Reducing Balance Automobile Depreciation Rates Vehicle Values

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Free Macrs Depreciation Calculator For Excel

Section 179 Deduction Hondru Ford Of Manheim

Macrs Depreciation Calculator Irs Publication 946

Tax News Depreciation Guru